How BVI importers, distributors and developers can turn policy into profit – while helping the Territory hit its 60% renewables target.

Executive Snapshot

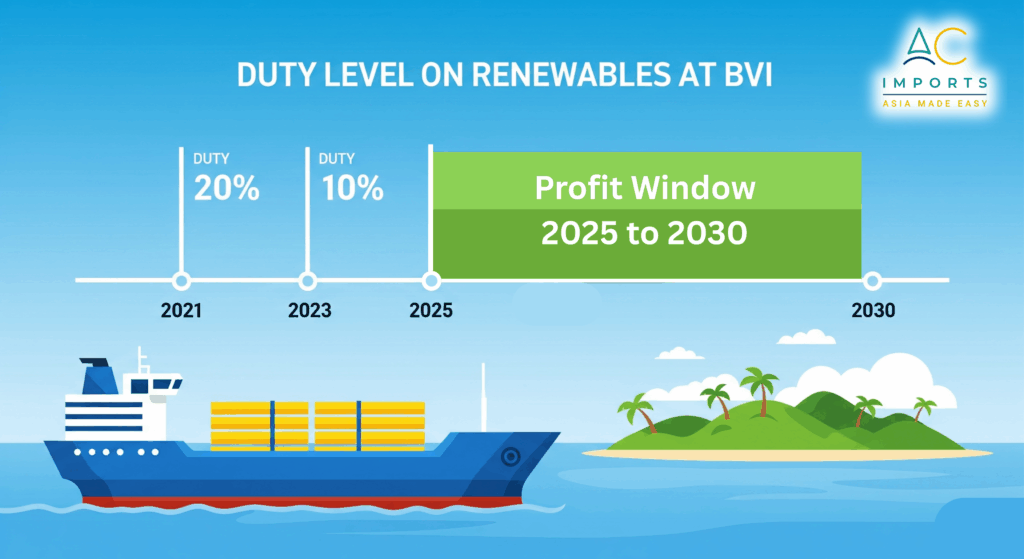

From 1 September 2025 to 31 August 2030, the Virgin Islands Government has set customs duty at 0% on all renewable energy and energy-efficient products imported into the Territory. (gov.vg)

For BVI-based businesses, that creates a rare five-year window where:

- Your landed cost on solar and other green technologies drops immediately – removing a duty that was set to sit at around 10% for many products. (virginislandsnewsonline.com)

- Government programmes like STEP prove the model and signal rising demand, but cannot meet it alone. (virginislandsnewsonline.com)

- US tariffs on Chinese-origin and Southeast Asian solar goods are spiking, making traditional “via Miami” routes higher risk and higher cost. (PV Tech)

AsiaCaribbean Imports was built to connect BVI businesses directly with vetted Asian manufacturers – with tier-1 solar equipment, consolidation and QC in Asia, and direct shipping to the BVI. (Asia Caribbean – Asia Made Easy)

The result: better pricing, cleaner logistics, and a clear, compliant path to supply the BVI’s green transition.

1. What Changed: The New Zero-Duty Regime

In August 2025, the Government approved a major shift in how renewable and energy-efficient products are treated at the border:

- Zero customs duty for five years, from 1 September 2025 to 31 August 2030

- Applies to all renewable energy and energy-efficient products imported into the Territory

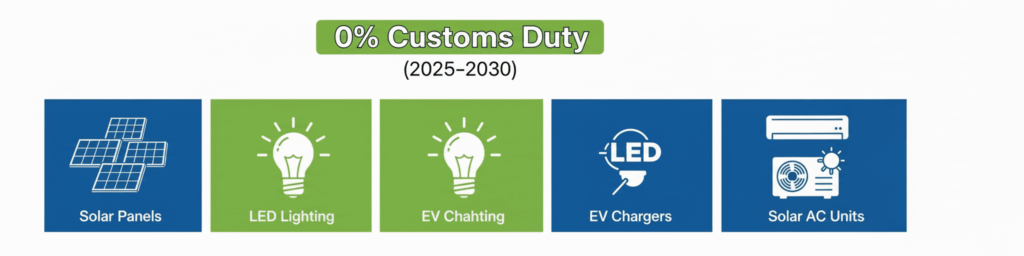

- Explicitly includes, but is not limited to: (gov.vg)

- Solar panels, solar water heaters and solar lighting

- Solar air conditioners and solar appliances

- Technologies harnessing wind power

- Electric vehicles and charging infrastructure

- LED fixtures and bulbs

This builds on an earlier two-year concession (2021–2023) and replaces a planned 10% customs duty on many renewable imports. (virginislandsnewsonline.com)

For importers, distributors, EPCs and large property owners in the BVI, that means:

- Every container of solar and energy-efficient equipment lands with 0% duty

- You can either keep that 10% differential as additional margin or pass some of it on to customers to make projects more attractive and speed up their payback.

This isn’t just an environmental gesture – it’s a multi-year structural margin boost aligned with the Territory’s goal of having 60% of its energy generated from renewables by 2030. (gov.vg)

2. Demand is Already Here: STEP, High Power Costs & Latent Market

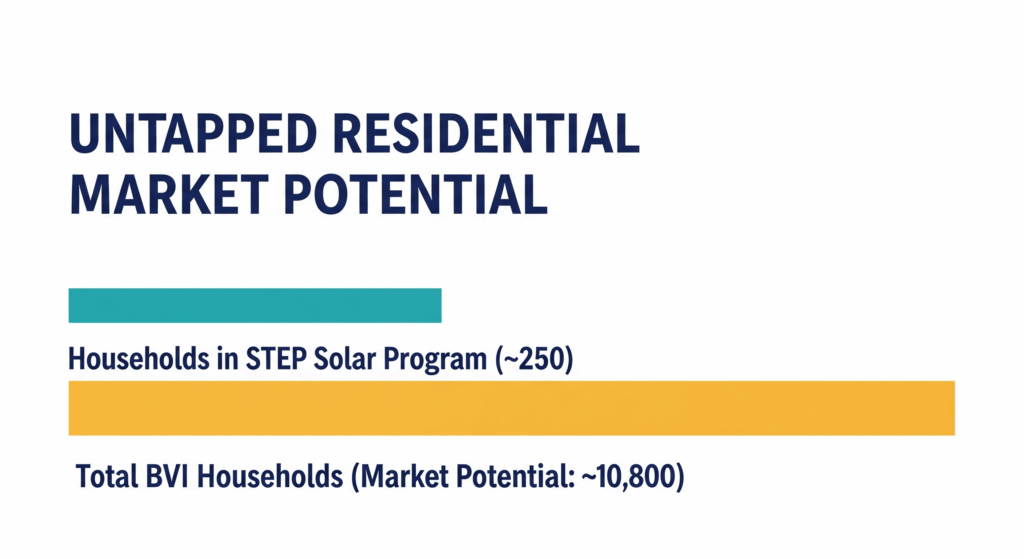

The Solar Technology Energy Programme (STEP) has already shown BVI residents that solar works – and that the appetite is strong. Public updates indicate:

- Over 250 homeowners have now signed up to STEP, with applications rising steadily. (virginislandsnewsonline.com)

- Government commentary points to well over two hundred applications for solar systems, with installations being rolled out in phases. (gov.vg)

At the same time:

- The BVI’s electricity prices are well above US$0.20/kWh, typical of small, diesel-dependent island grids – a strong financial incentive to reduce grid dependence. (Voronoi App)

Taken together, that creates three clear demand signals:

- Proven residential interest

Homes that have seen neighbours install solar – whether through STEP or private projects – are more likely to move ahead once they can access equipment at competitive, duty-free prices. - Commercial and hospitality opportunity

Hotels, villas, offices and mixed-use buildings typically consume more power, making rooftop PV and high-efficiency equipment financially compelling once the imported hardware is duty-free. - Fleet and mobility transition

With EVs and charging infrastructure now also at 0% duty, there is a path for fleet operators and taxi associations to begin a staged transition away from pure ICE vehicles. (gov.vg)

Your role, as a BVI-based trader, developer or asset owner, is to supply this demand even when it falls outside government programmes. STEP is important – but it will not cover every roof, every small business, or every hotel.

3. The Margin Story: Turning Zero Duty into Profit

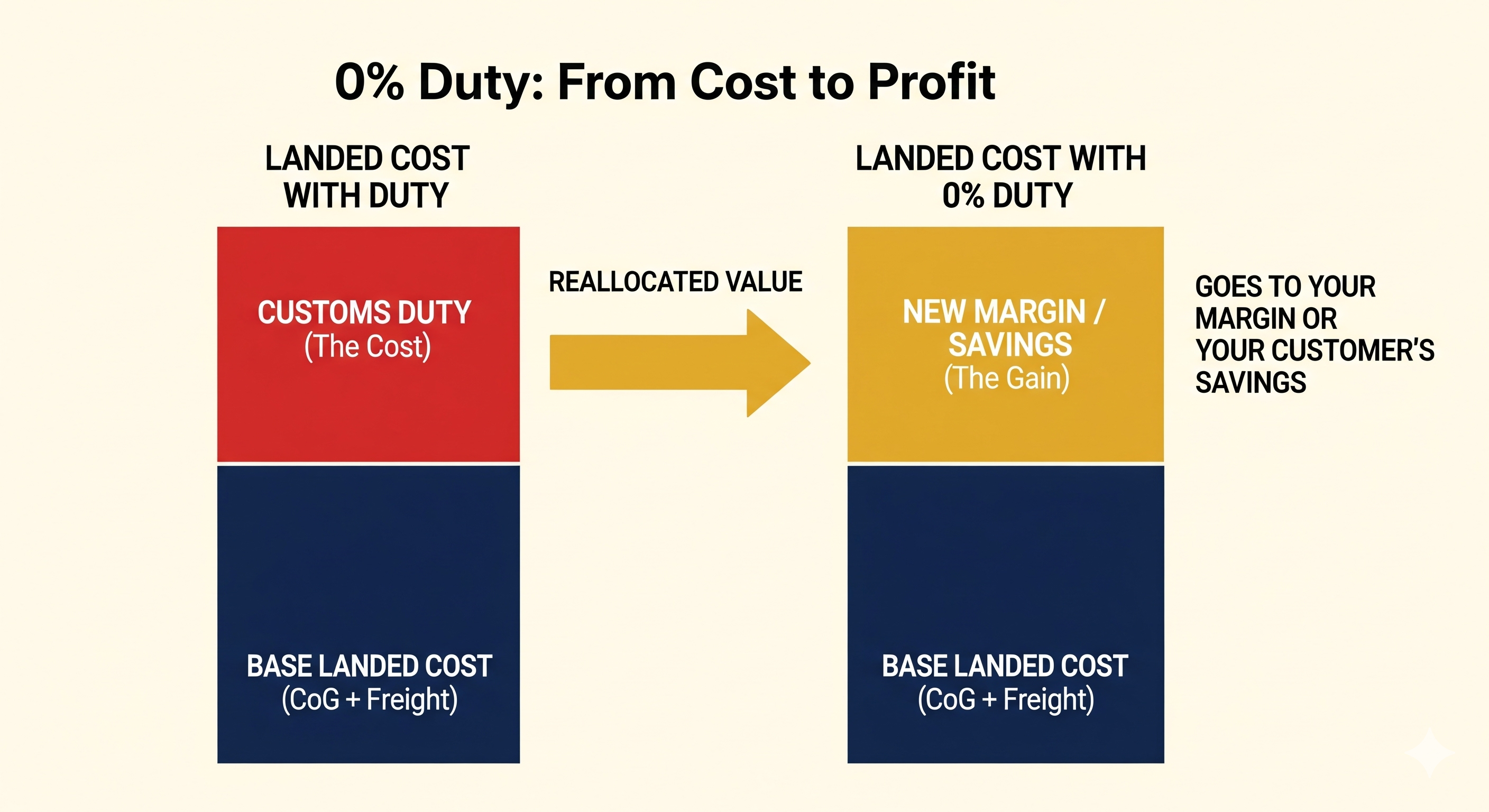

For a typical shipment of solar equipment or energy-efficient products, your total landed cost includes:

- Ex-factory price

- Inland transport and consolidation

- Ocean freight and insurance

- Customs duty and fees

- Local handling and delivery

Removing a 10% customs duty line (which would otherwise apply to many renewable imports post-2023) gives you options:

- Option A – Protect margin:

Keep pricing steady, and allow that 10% duty saving to flow through as additional gross margin to your business. - Option B – Accelerate payback:

Share part of the duty saving with your customers through sharper pricing, improving their project payback and making it easier to close deals. - Option C – Blend:

Use some of the saving to sharpen your pricing, and some to strengthen your own margins – a balanced, sustainable approach.

Whichever you choose, the key point is this:

Zero duty is not just a policy win; it is five years of structurally lower landed cost for every compliant shipment.

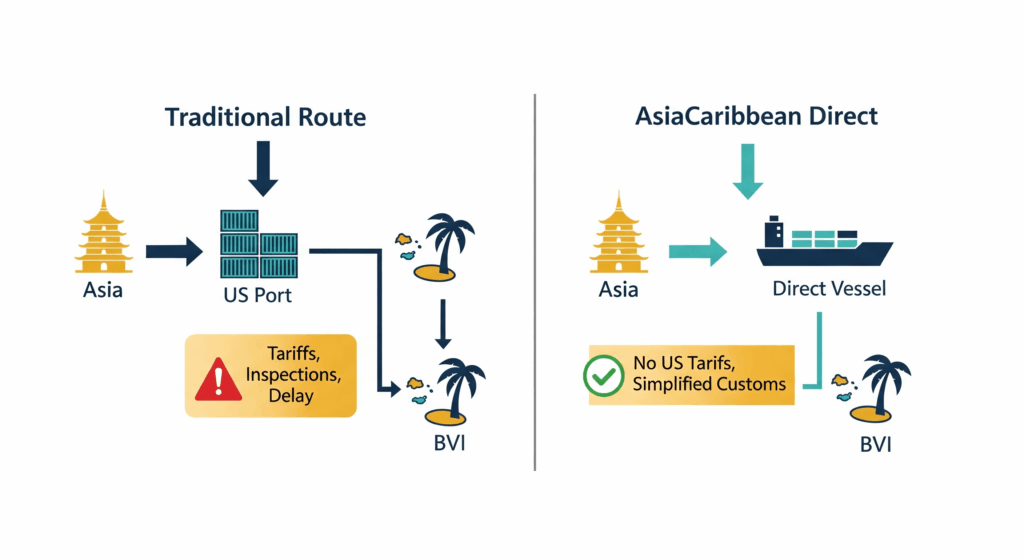

4. The US Tariff Risk – And How to Avoid It

For many years, Caribbean and BVI importers have routed containers via US ports – especially Miami – out of habit. With the new US trade environment, that habit can be expensive.

Recent policy changes include:

- So-called “reciprocal tariffs” announced in April 2025, applying additional tariffs of over 30% on certain countries, with rates such as 49% for Cambodia, 46% for Vietnam and 36% for Thailand – all key manufacturing locations for Chinese-owned solar capacity. (PV Tech)

- Final US anti-dumping and countervailing duties on solar cells and modules from Cambodia, Malaysia, Thailand and Vietnam, with effective rates from ~41% to over 3,500%, depending on the company and product. (Reuters)

What this means in practice:

- If your container of Chinese-origin or Southeast Asian-produced solar equipment is routed as US imports, you can be exposed to very steep, sometimes unpredictable tariffs.

- Even where goods move in bond for onward shipment, increased scrutiny around rerouting and tariff circumvention means greater risk of delay, inspection and cost surprises.

For a BVI business, there is no strategic upside to this exposure.

AsiaCaribbean’s Routing Advantage

AsiaCaribbean’s logistics model is designed around direct, compliant routes from Asia to the BVI, avoiding unnecessary stops that add risk:

- No US customs clearance on your solar cargo – your shipment is not treated as a US import.

- Consolidation and quality checks at origin in Asia, so you ship exactly what was ordered. (Asia Caribbean – Asia Made Easy)

- Documentation tailored to BVI Customs requirements, reducing clearance friction on arrival in Road Town. (Asia Caribbean – Asia Made Easy)

The result is a straightforward proposition for BVI executives: Use direct Asia → BVI routes to keep your equipment outside the US tariff crossfire, and combine that with BVI’s 0% duty to protect your project economics.

5. Why Work With AsiaCaribbean Import?

AsiaCaribbean Import is headquartered in Wickhams Cay One, Road Town, Tortola, and built specifically to serve BVI and wider Caribbean importers. (Asia Caribbean – Asia Made Easy)

For renewable and energy-efficient imports, we focus on four things that matter to senior decision-makers:

- Tier-1, Vetted Suppliers

- Direct relationships with tier-1 solar panel, inverter and battery manufacturers

- Factory-level vetting and ongoing quality control to reduce product risk (Asia Caribbean – Asia Made Easy)

- Consolidation & Quality Control in Asia

- Multi-factory consolidation for mixed shipments (e.g. panels, hybrid inverters, racking, EV chargers)

- Pre-shipment inspections and documentation, so you know what’s leaving the port – not just what’s on the paperwork. (Asia Caribbean – Asia Made Easy)

- Routing Optimised for BVI

- Shipping plans designed to bypass US tariff exposure and deliver directly to the BVI

- Coordination of freight, carrier management, customs paperwork and final-mile delivery in the Territory (Asia Caribbean – Asia Made Easy)

- Compliance & Documentation Support

- Alignment with the BVI’s documentation expectations for smooth customs clearance

- Access to practical tools like our Import Documentation Checklist and other BVI-specific resources (Asia Caribbean – Asia Made Easy)

In other words: we handle the sourcing, logistics and paperwork so you can focus on project development, sales and operations.

6. How BVI Businesses Can Act During the 5-Year Window

If you’re a BVI-based trader, EPC, developer or asset owner, here’s a simple sequence to turn the zero-duty policy into a concrete plan:

- Identify your green product lines

- Solar (panels, inverters, mounting, BOS)

- Solar water heaters, LED lighting, solar AC

- EVs and charging infrastructure

- Map your current sourcing and routes

- Where are you buying from now?

- Are you routing via US ports (especially for Chinese or Southeast Asian-origin goods)?

- Quantify your potential duty savings

- Compare landed cost with a 10% duty vs 0% for the next five years

- Decide how much of that saving strengthens your margin vs your customer offer

- Shift to a direct, BVI-optimised supply chain

- Work with AsiaCaribbean to design routes that avoid US tariff risk and align with BVI Customs expectations

- Consolidate orders where sensible to reduce per-unit logistics costs

- Build offer packages for your customers

- Residential packages (e.g. typical rooftop systems or hybrid inverter + storage)

- Commercial packages for hotels, offices and mixed-use buildings

- EV + charger bundles for fleets and property owners

7. Ready to Lead the Green Charge in the BVI?

The Virgin Islands are at a turning point:

- A clear policy signal – 0% customs duty on renewable and energy-efficient products for five years

- A strategic national goal – 60% of energy from renewables by 2030

- Proven demand – hundreds of households already in STEP, and thousands more homes and businesses still to be served

For BVI businesses, the question is simple:

Will you be the importer, developer or owner who turns this window into long-term value – or watch competitors move first?

AsiaCaribbean Import is ready to help you design the right sourcing strategy, select the right products, and move them from Asian factory floor to BVI project site with confidence.

Let’s turn BVI’s green horizon into your next profit centre.